- 0

- January 9, 2025

- GEMs3.0 Resources

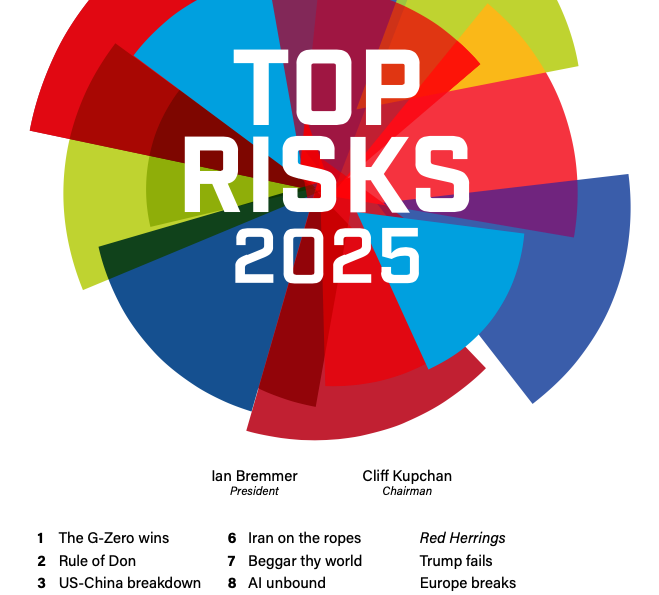

Top Risks 2025

From a certain perspective, 2025 looks extraordinary. If we encountered our planet today as an alien species, without fear or favor, what would we see? A growing population of eight billion people in the midst of unprecedented expansion and growth; staggering opportunities after tens of thousands of years of stagnation. Even...

- 0

- December 30, 2024

- GEMs3.0 Resources

2025 Investment Management Outlook

With increasing investor appetite for low-cost funds, the low-expense ratio environment may be here to stay with active management finding a home inside the exchange-traded fund (ETF) wrapper. Expanding the product lineup into alternative investment offerings such as private credit and evergreen or hybrid fund structures, as well as investing in...

- 0

- December 17, 2024

- GEMs3.0 Resources

EY Global Institutional Investor Survey 2024

The global EY organization has been assessing investor sentiment on corporate sustainability performance – also known as environmental, social and governance (ESG) performance – for over a decade. During that time, there has appeared to be an increasing trend for institutional investors to care about, and embed, ESG into their...

- 0

- December 3, 2024

- GEMs3.0 Resources

Green Technology Book: Energy Solutions for Climate Change

Climate change impacts are here. And they are here in force. In 2022 alone, several tragic records were broken and the trend toward more frequent, extreme weather events becomes increasingly apparent with every year that passes. Adaptation is a necessity. Despite decades-long warnings and increasingly desperate calls for action, the...

- 0

- December 3, 2024

- GEMs3.0 Resources

Reconciling Portfolio Diversification with a Shrinking Carbon Footprint

Net-zero-aligned portfolios (NZPs) are dynamically constructed so that their carbon footprint—defined as the market share of the carbon footprint of constituent stocks in the portfolio—is shrinking over time to achieve a net-zero (NZ) footprint by a target date (typically 2050). The basic aim of NZP construction is to reduce the...

- 0

- November 27, 2024

- GEMs3.0 Resources

ADB Sovereign Default and Loss Rates

This report provides data on default and loss rates in the sovereign lending of the Asian Development Bank (ADB) from 1990 to 2023. Its analysis finds zero loss of principal, interest on principal, or fees on the more than $250 billion of loans disbursed during this 34-year period. The average...

- 0

- November 8, 2024

- GEMs3.0 Resources

Investing in Nature as Infrastructure The Opportunity

The dual crises of climate change and biodiversity loss continue to be in the spotlight. Increasingly, it is accepted that the crises are inextricably linked, and that to solve either crisis effectively, both must be addressed together. The Kunming-Montreal Global Biodiversity Framework (GBF) sets the stage for a decade ofaction...

- 0

- November 4, 2024

MDB Risk Transfer: Business Models & Data

This report aims to provide Multilateral Development Banks (MDBs) with a roadmap for the implementation of truly scalable risk transfer. To do this, it reviews the risk transfer techniques employed by commercial banks and US mortgage refinance agencies and then sets out proposals for how MDBs could proceed. The so-called ‘billions...